Looking for more insights like this? Check out our compensation benchmarking offerings. Our Premium and Enterprise tiers include exclusive insights on competitive compensation structures.

Equity grants are a common part of most compensation packages, especially within the tech industry, and companies have typically utilized them to align employee interests with the long term success of the business and also reduce turnover by getting employees to stay with the company for longer.

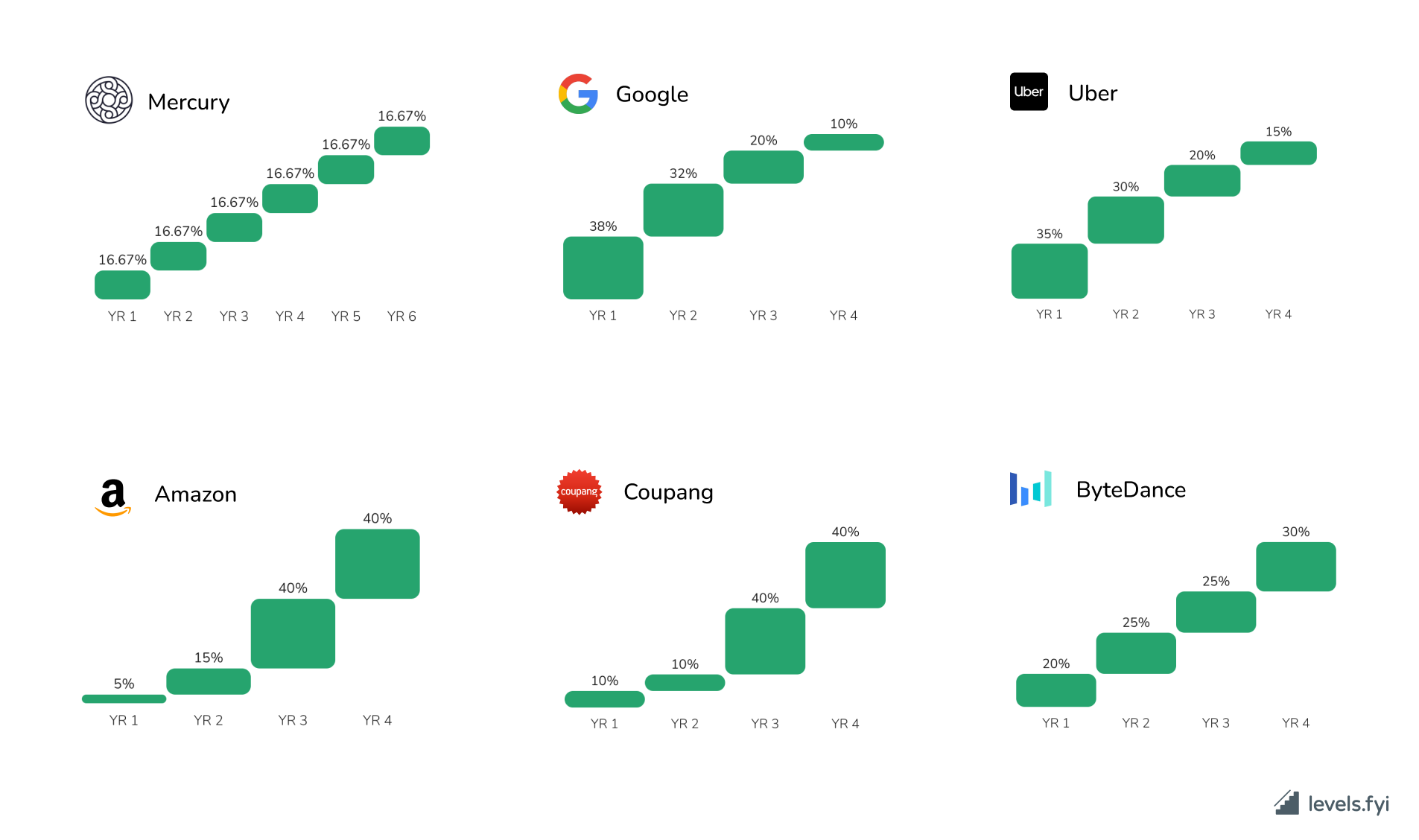

Traditionally, companies will use a 4-year vesting schedule, where employees will get 25% of their total equity grant every year for 4 years as long as they’re with the company. With rapidly changing economic and job markets though, more companies have started experimenting with unique vesting schedules as a way to attract more talent while also saving money. We wanted to highlight a few of those companies in this post.

Amazon’s vesting schedule is probably most notorious in tech for being unique, where employees only get 5% of their equity grant after year 1, 15% after year 2, and 40% after years 3 and 4 (notated as 5/15/40/40). In order to compete with other companies in the short term, they also offer sign-on bonuses which get paid through the first 2 years as a way to make up for the limited equity vesting during that time.

Companies like Google, Uber, Coupang, ByteDance, and Stripe all now adopt non-traditional vesting schedules, which you can see below. Google, specifically, has continued experimenting through the years where we’ve seen vesting schedules like 33/33/22/12, 36/28/20/16, and others before they’ve landed on their current schedule of 38/32/20/10. Some companies (including Google) even offer some candidates a choice of their vesting schedule, so they’ll present a few different options for their employee to decide what makes sense for them.

Companies like Mercury even have longer 6 year schedules as opposed to the default of 4 years.

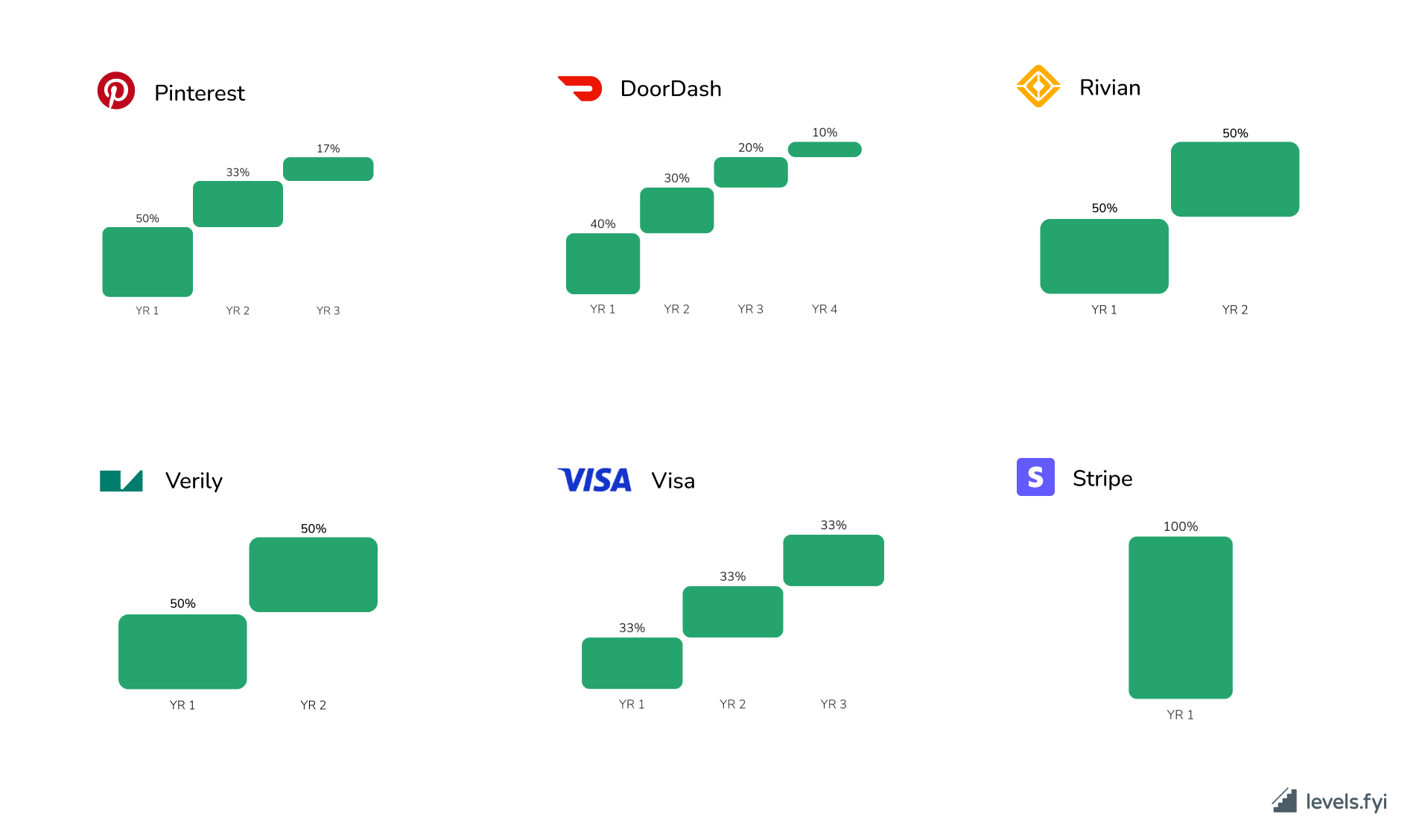

Other companies like Pinterest and DoorDash have also recently updated their vesting schedules in response to current market conditions. Pinterest now uses a 3 year schedule with a 50/33/17 split, while DoorDash uses a 4 year schedule with a 40/30/20/10 split.

Companies like Rivian offer 2-year grants, while Stripe offers a 1-year grant.

For a lot of these companies, these grants are typically net lower than they used to be, even if the first year total matches or exceeds what it was before. The supposed purpose of these schedules is to reduce immediate RSU burn for the company. Instead of locking in a single stock price for a whole 3-4 years, companies will issue refreshers and re-price in the latter years rewarding high performers and letting non-performers either "walk" or take a hit on their compensation.

If you have an offer from a company with a unique vesting schedule and aren’t sure how to consider the implications of it, our negotiation coaching can help you understand it and negotiate the compensation package to give you the best long term benefit.